Home loan offset accounts and redraw facilities work in similar ways; they both allow you to reduce the balance of your home loan, and therefore the interest charged, by applying extra money to your debt.

Redraw

A redraw facility allows you to access extra repayments that you may have made on your mortgage.

How does this save you money? By depositing extra money into your home loan, you are reducing the amount of interest charged to your loan as your loan balance is reducing. If you had this money sitting in a savings account you would be earning interest (and possibly paying tax on it) and the interest rate is generally at a lower rate than the interest rate on your home loan. For example, if your home loan interest rate is 4% and your savings account is earning interest of 1%, it makes sense to reduce the amount of interest on your home loan by depositing the money there.

The extra money paid will lower the amount of interest charged while still giving you access to your money.

A redraw facility allows you to draw the extra amount you have paid to your loan back. This is just like completing a withdrawal on a savings account.

However, there may be restrictions on how much money can be withdrawn and when.

For redraw, it depends on whether the facility applies to a fixed-rate or variable loan. Most institutions only allow a redraw from a variable-rate loan, or fixed-rate loan but with limited access. Some lenders will not allow a redraw at all on a fixed-rate loan.

It is important to find out how a loan’s redraw facility works before taking it on, as any restrictions attached might outweigh the benefits of interest savings. Most lenders do not charge a fee for a redraw unless you ask them to complete the transaction for you. If you process the redraw via your internet banking most lenders will not charge a fee.

A redraw facility is also a feature of a home loan and the lender can legally stop you from withdrawing the redraw funds. This is covered in the fine print of the loan terms and conditions. It is very rare that a lender will do this, but they can.

Offset

An offset account is an account that is linked to your home loan in such a way that it reduces the amount of interest that you pay.

When you have an offset account, you do not earn any interest on your savings. However, you are benefiting as the interest on your savings is actually working to reduce the interest on your home loan.

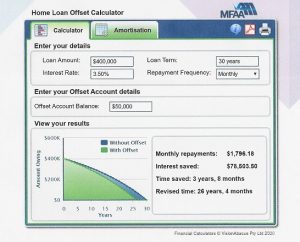

Most lenders offer a 100% offset facility. How does this work? If your home loan has a balance of $400,000 and your offset account has a balance of $50,000, then the interest charged to your home loan is calculated on a balance of $350,000.

In the image below you can see that if $50,000 was left in the offset account for the life of the loan, the loan term would be reduced by 3 years & 8 months and the interest saved would be $75,503.50.

Check out the offset calculator on our website for this here.

Offset accounts, like many savings accounts, often come with account fees, but the fee may be worth the interest savings and the added flexibility compared to redraw facilities.

An offset account generally has all the features of a standard transaction account. You can have a debit card connected, you can have your salary deposited and you can organise to have all your day to day transactions run through the account. Some lenders also allow multiple offset accounts to be linked to your home loan. Lenders may have small differences on how they offer this product.

The offset account is a very flexible product to have and you can withdraw money at any time you wish. It is a separate account to your home loan and the bank cannot stop you from withdrawing your money.

Deciding between an offset account and a redraw facility on your home loan largely depends on how accessible you need your extra money to be.

Finding a loan that matches your needs is a lot easier with an expert on your side. Speak to us at Wyze Finance so we can find a suitable product just for you.

This page provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. It does not constitute legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances. All loan applications are subject to lenders terms and conditions, and eligibility criteria. Lender fees and charges will apply.